E Filing Status

Your 2021 Tax Return Status in 2022 After e-Filing Your Taxes

Steps to check your tax return status: Sign in here to your existing eFile.com account. Once you have signed in, you will see your return status on the front page. You do not have to navigate anywhere to find it - the message will display some additional information regarding your return, such as the acceptance date.

https://www.efile.com/my-tax-return-status/

What Is My Filing Status? | Internal Revenue Service - IRS tax forms

Your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax. If more than one filing status applies to you, this interview will choose the one that will result in the lowest amount of tax. Information You'll Need

https://www.irs.gov/help/ita/what-is-my-filing-status

Modernized e-File (MeF) Status | Internal Revenue Service - IRS tax forms

Modernized e-File (MeF) System Resiliency: Starting with Release 10.5 (start date 10/12/2021 for ATS and January 2022 for Production) MeF has implemented a new feature which allows the application to function in a limited capacity during system outages. The feature known as “MeF Resiliency” will allow only Send Submissions service and issue ...

https://www.irs.gov/e-file-providers/modernized-e-file-mef-status

Electronic Filing (e-file) | Internal Revenue Service - IRS tax forms

Frequently Asked Question Subcategories for Electronic Filing (e-file) Age, Name or SSN Rejects, Errors, Correction Procedures. Amended Returns. Forms W-2 & Other Documents. Due Dates & Extension Dates for e-file. Back to Frequently Asked Questions.

https://www.irs.gov/faqs/electronic-filing-e-file

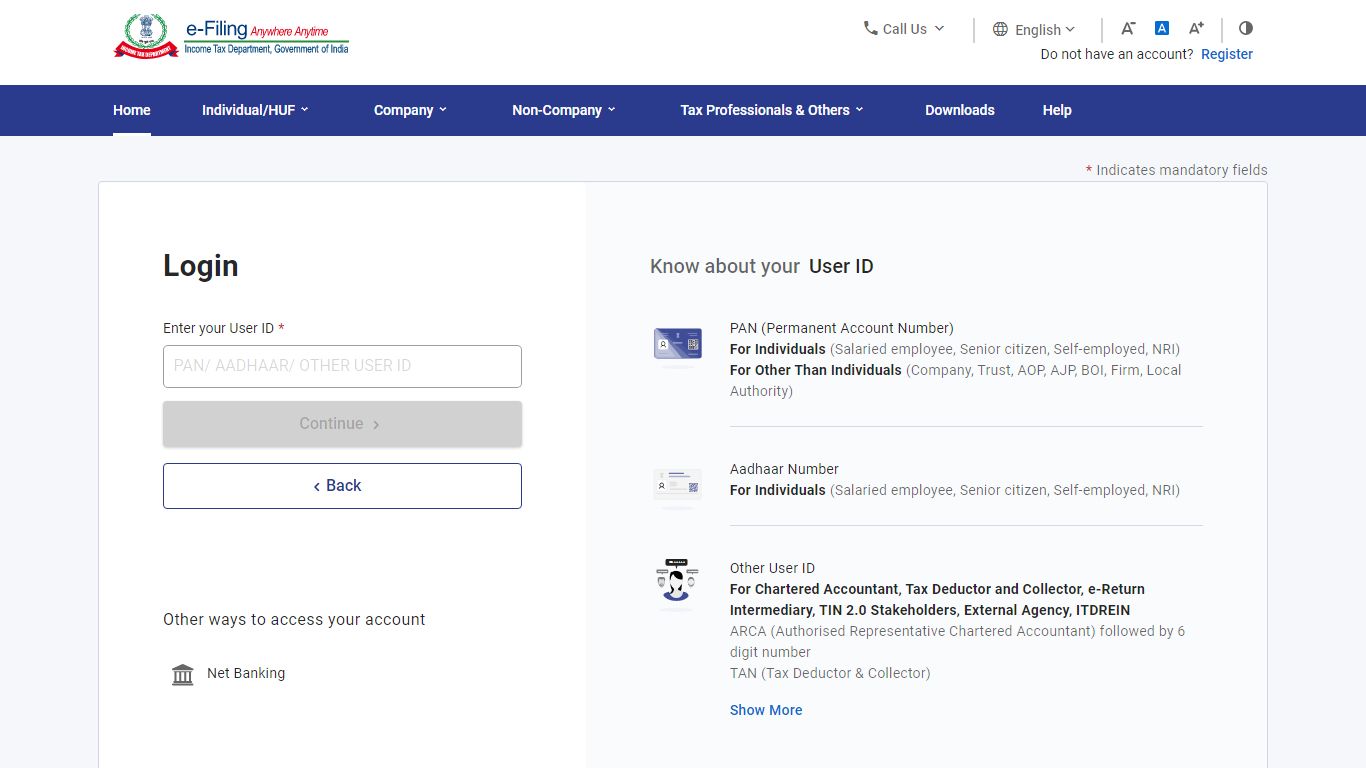

e-Filing Home Page, Income Tax Department, Government of India

e-Filing Home Page, Income Tax Department, Government of India ... loading

https://eportal.incometax.gov.in/iec/foservices/

E-file Provider Services | Internal Revenue Service - IRS tax forms

Circular 230 Practitioners need only apply and be approved. Access e-file Application *requires login credentials E-file Transmission You must have an e-Services username and password and a completed e-file application before participating. A2A This method uses Automated Enrollment (AE) to enroll and maintain the A2A Client Application Systems.

https://www.irs.gov/tax-professionals/e-file-provider-services

Meaning of efiling status | TaxTim SA

18 November 2015 at 13:28. I did get a ITA34 the day I filed my tax returns. Previous to the status showing filed, it said correction filed. TaxTim says: 18 November 2015 at 18:55. This still means your return has been filed and submitted to SARS. This entry was posted in Tax Q&A and tagged Salary / IRP5, Audit / Verification, SARS & eFiling .

https://www.taxtim.com/za/answers/meaning-of-efiling-status

Home | Income Tax Department

E-filing portal is working fine and full speed working ITR 30-Jul-2022 Even on 30th July 2022, portal is working excellent without any glitch. Returns filed are processed & intimation received within 12 hours. 30-Jul-2022 In last 2-3 years..this year only hassle free itr are being filed even on last days. No issues of crashing of site 30-Jul-2022

https://www.incometax.gov.in/iec/foportal

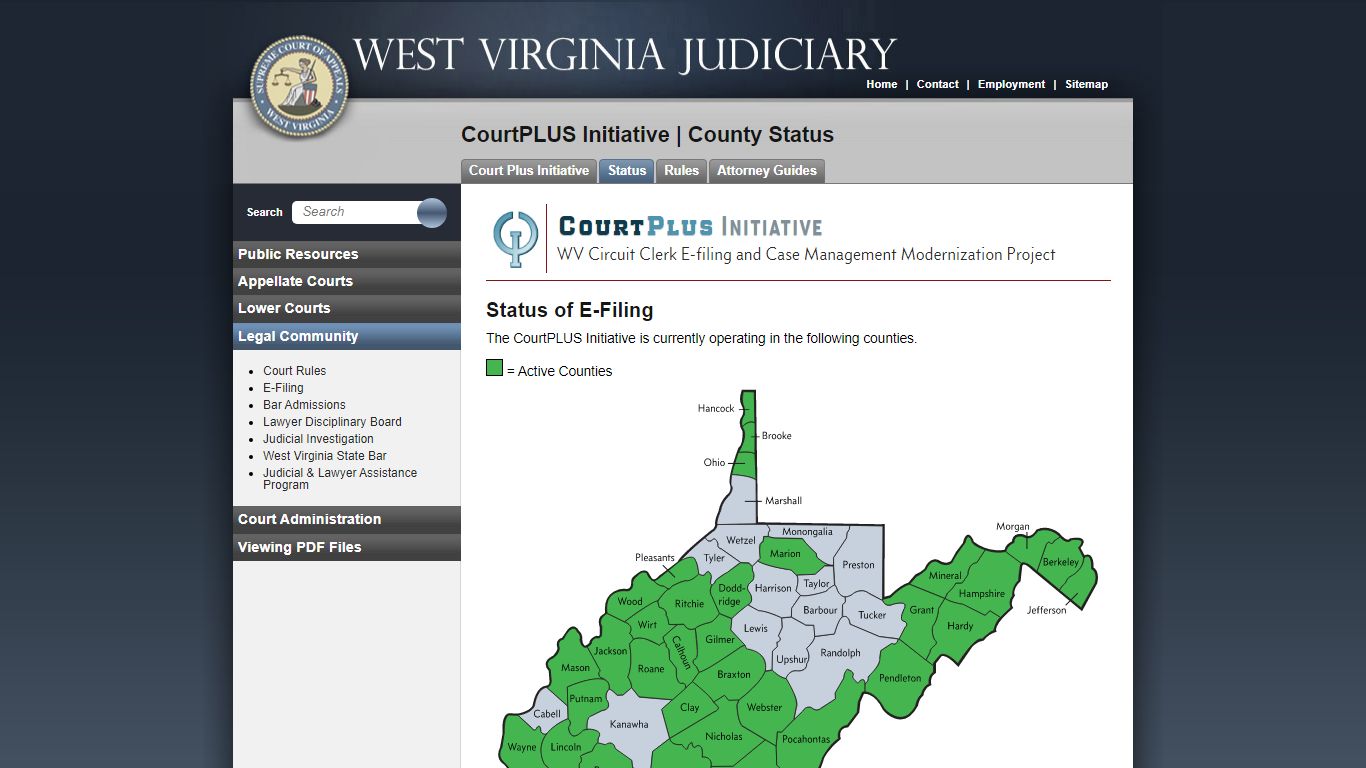

CourtPLUS Initiative - Status | West Virginia Judiciary - courtswv.gov

WV Circuit Clerk E-filing and Case Management Modernization Project. Status of E-Filing. The CourtPLUS Initiative is currently operating in the following counties.

http://www.courtswv.gov/e-file/status.html

ezHASiL

. © Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia

https://ez.hasil.gov.my/CI/eFiling.aspxKnow your ITR Status User Manual | Income Tax Department

At least one ITR filed on the e-Filing portal; 3. Process/Step-by-Step Guide. 3.1 ITR Status (Pre-Login) Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue.

https://www.incometax.gov.in/iec/foportal/help/how-to-know-the-itr-status

How do I check my e-file status? - Intuit

Watch on. To check your e-file status, sign in to TurboTax, and go to Tax Home (if you're not already there). If you've submitted your return, you'll see pending, rejected, or accepted status. If you haven't submitted your return yet, you'll see a let's keep working on your taxes! message and sections like Personal Info and Income & Expenses.

https://ttlc.intuit.com/turbotax-support/en-us/help-article/electronic-filing/check-e-file-status/L9XhHDPtD_US_en_US